The next BTC crash could be something to behold

This post is to explain my position on bitcoin and hopefully expedite the disappearance of the ecological scourge that is proof-of-work blockchain tech.

Disclaimer: I have short positions on cryptocurrency related stocks

My blog is generally about poking holes into lazy arguments and bad research. So making this post about an incoming market crash like a clickbait hack feels wrong, but this time I think it’s justified.

First here’s a TL;DR:

-

The current parabolic price increase in Bitcoin is a bubble.

-

A stablecoin called Tether is either one of the largest frauds or money laundering operation in history[footnote]There’s no third option[/footnote], and is providing most of the liquidity in the cryptocurrency ecosystem.

-

A BTC bubble pop, incoming regulation on stablecoins, FinCEN transit rule changes or the current NYAG investigation into tether will expose tether’s insolvency to the crypto market [footnote]I’m not picky about how my short position resolves itself, really[/footnote]. This is bigger than it sounds.

-

(Speculative, but one can hope) Current prices to mine BTC could end up higher than BTC market price, exposing BTC to a 51% attack.

-

The best way to exploit this position financially is by shorting or buying puts on MSTR, which is hilariously overvalued. Disclaimer: If you barely know how shorting works or what an option is, please don’t bet money on some idiot [footnote]me[/footnote] advice on the internet.

A Recap: Bitcoin is useless and should go away

Bitcoin serves no purpose. Let’s just rehash that by quickly debunking the major claimed uses over time:

-

Proof of concept: No argument here, but now that the market cap of cryptocurrencies is closing in on a $700B, this seems moot.

-

Cheap Payment Network: Nonsense, since BTC transactions are currently >$10 and this worsens the more people use it.

-

Anonymous Darknet Currency: I’d have said “no argument here”, but apparently it’s surprisingly easy to trace BTC nowadays. However, crypto ecosystem as a whole seems to do a decent job at laundering money as we’ll see later.

-

Reserve Currency for Crypto: Since a reserve currency should be useful as a means of exchange, and I wrote several thousand words on how BTC is not that, my position is pretty clear. Also, the fact that a cryptocurrency indexed to the US dollar has trounced BTC as the main means of exchange in the crypto ecosystem speaks for itself.

-

Programmable Shared Database: You know what’s programmable, shared and a database? The database we use at work. Just learn to implement access control lists on your SQL server.

-

Uncorrelated Financial Asset: Given BTC crashed just like the rest of the market when COVID showed up, this doesn’t hold up:

The stupidest version of the “uncorrelated asset” argument I hear[footnote]Often at that[/footnote] is “Bitcoin is a great hedge for inflation!”

You know what’s a good “hedge for inflation”? Literally anything. The definition of inflation is “the price of money”. If the price of money goes down (inflation) then everything else has a positive return by comparison.

People who say “bitcoin is a good hedge for inflation” shouldn’t be trusted to manage their own money, let alone give financial advice to anyone.

- Censorship Resistant e-Gold: This is a roundabout way of saying “BTC is a store of value”! Which, again, can only be said by people who’ve never read the definition of “store of value” in a textbook.

I already went into detail into this, but BTC is a terrible store of value because it’s volatile. Assets that can lose 20% of value overnight don’t “store value”. BTC is a “vehicle for speculation”.

The only way price is sustained for BTC is that you can find some other idiot to sell it to. Just as a reminder, 50% of Gold is used for things that aren’t speculation, like Jewelry, so you’ll never have to worry finding a seller there.

Here are some real uses for bitcoin:

-

Gambling is fun. You buy BTC, the price might go up! Or down! This is exciting[footnote]Also explains why the suicide hotline numbers get pinned to r/bitcoin whenever there’s a crash. I’m not joking[/footnote].

-

Hackers, money launderers and other criminals certainly find cryptocurrencies useful.

Reminder: BTC is an ecological scourge

The current cost to mine a BTC is around $8000 in electricity. This electricity mostly comes from subsidized coal in China.

And given the current amount of BTC generated each day, we’re using about equivalent to the electricity from all of Belgium, largely in coal, to keep this going.

I don’t mind wasting time on intellectual curiosities, but destroying our planet for glorified gambling is not something I’m happy about. I want cryptocurrencies to go away entirely on this basis, philosophically.

Current BTC prices are a bubble

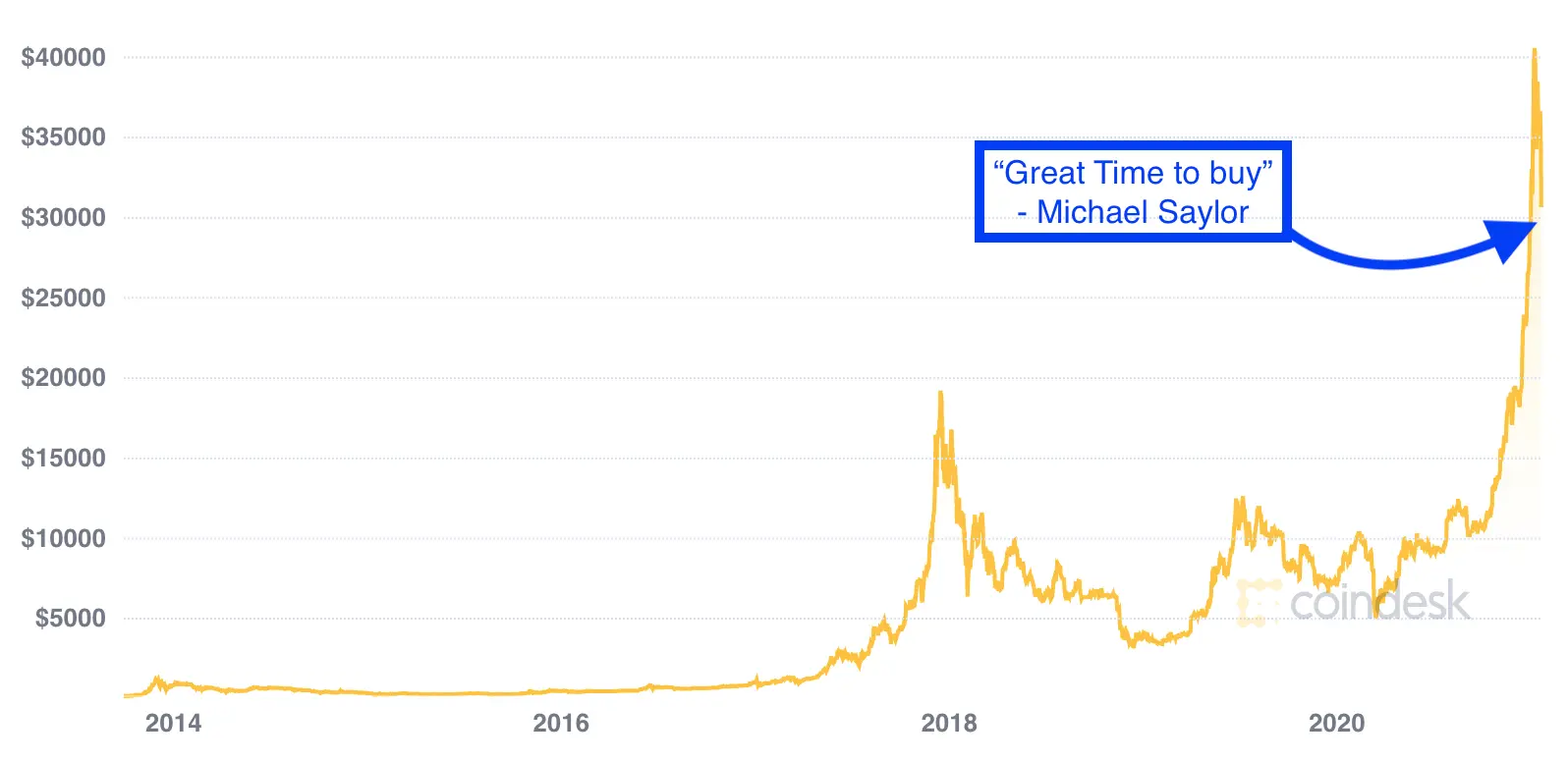

Before we go into tether, reminder that at the time of writing, the plot of BTC price against the S&P500 looks like this:

BTC price has increased by ~800% since March. Still, no one uses it for anything useful since the last bubble in 2017[footnote]Seriously, recall the chart of claimed uses in the previous section[/footnote], or the other one before that in 2013. This is another bubble however you put it.

BTC is not “new technology”

10 years the internet became popular, Google and Amazon already existed. We’re 8 years after the popular emergence of deep learning and it has already revolutionized machine translation, computer vision and natural language processing in general.

You could argue that deep learning and the internet existed before their emergence, but so did cryptocurrencies[footnote]Look up b-money and hashcash for instance[/footnote].

Bitcoin has existed since 2008 and emerged in popularity around the same time as deep learning did, yet we’re still to find actual uses for it except ~gambling~ speculation and criminal uses. It’s a solution waiting for a problem.

Institutional investors are also idiots

The narrative this time is that “institutional investors” are buying into BTC. This doesn’t mean it’s not a bubble.

Many of the institutions were buying through Grayscale Bitcoin Trust. Rather, many of them were chasing the premium over net asset value that hovered around 20%. Basically, lock money in GBTC for 6 months, cash out and collect the premium as profit. Of course, this little Ponzi couldn’t last forever and the premium seems to be evaporating now.

Similarly, totally-not-a-bitcoin-ETF-wearing-a-software-company-skinsuit Microstrategy (MSTR) trades at a massive premium over fundamentals.

There will always be traders chasing bonuses from numbers going up, regardless what is making the number going up. The same “institutional investors” were buying obviously terrible CDOs in the run-up to 2008.

Tether is lunacy

Tether is a cryptocurrency whose exchange rate is supposed to be pegged to the US Dollar. Initially this was done by having 1-to-1 US Dollar reserves for each tether issued. Then they got scammed by their money launderer, losing some $800M, which made them insolvent.

Anyway, now tether maintains their reserves are whatever they want them to be [footnote]According to their legalese: “traditional currency and cash equivalents and, from time to time, may include other assets and receivables from loans made by Tether to third parties, which may include affiliated entities”[/footnote] and they haven’t gotten audited since 2017.

You know, normal stuff.

There’s a problem to backing your USD-pegged security with something that isn’t US Dollars. Namely, if the price of the thing you’re backing your US Dollars against goes down, you’re now insolvent. If you were backing $10B in tether with $10B of bitcoin, then the bitcoin drops by half, you’re insolvent by $5B.

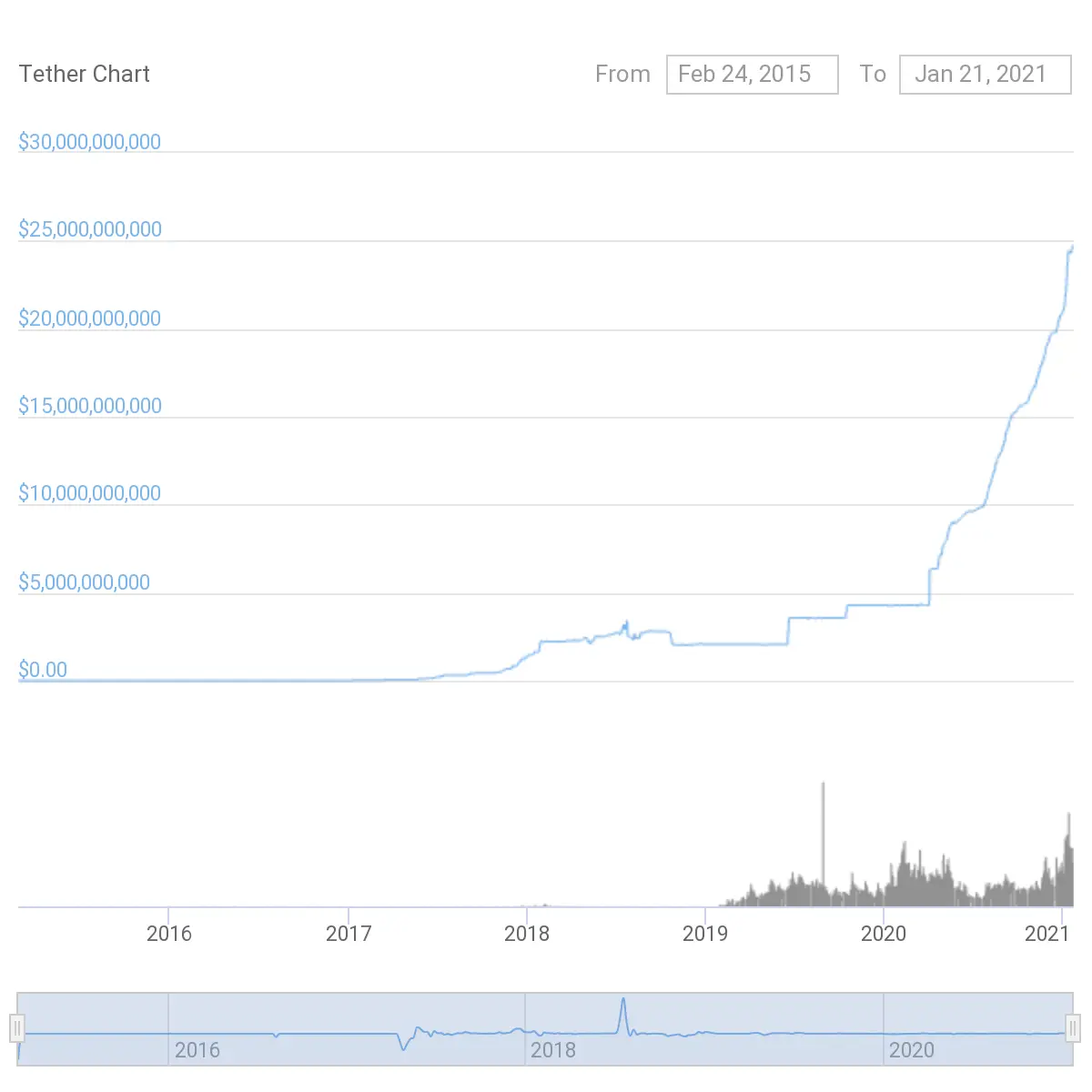

And then this spotlessly clean company they somehow added $20B to their balance sheet in the second half of 2020.

Reminder: one side of that balance sheet is currently floating around the cryptocurrency ecosystem. Cryptocurrency traders own it as an asset and sell it to others. The other half of the balance sheet is whatever tether wants.

There are only two possibilities that explain tether’s growth:

-

Massive unbacked issuances, because they’re afraid their scam has run its course.

-

Money laundering. Lots of it.

It could also be a happy mix of both.

One particularly interesting date is 30/8/2020, where tether started printing at an exponential rate. This is interesting because it predates the subsequent movement in bitcoin price and large movements in other cryptocurrencies.

The story from tether and tether’s bank’s CEO is that this money largely comes from foreign nationals through an OTC desk which implies the transaction goes as following:

-

A foreign national sends money in a foreign currency to an OTC desk. This is exactly as clean as you’d think – often raw cash transactions in the millions.

-

That OTC desk converts the money to USD and sends it to tether’s correspondent US bank. The OTC desk gives tether to the foreign national.

-

Wait tether has a correspondent US bank?

Oh, I forgot to mention, no bank wants tether as a customer because they obviously break KYC/AML compliance. So tether first bought invested in a bank called Noble which then lost its relationship with Wells-Fargo when they realized tether were lying to them about AML. Poor tether lost its legal access to USD.

Tether has been banking in the Bahamas with a bank called Deltec since. First they had a money launderer called Crypto Capital Corp to send funds to customers, who stole the $800M from them and subsequently went to jail.

But worry not! Tether found a way to get banked in USD afterwards. Curious coincidence, an executive at Deltec was randomly blogging about buying small US community banks in 2018. You know, that thing money launderers do.

So tether’s story is that in 2020, they took in roughly twenty billion USD of shady foreign money into the small community US bank their deltec bankers bought. These transactions are necessarily breaking KYC/AML. The foreign parties to those transactions wouldn’t take such a rickety route to convert billions into cryptocurrencies if they weren’t laughed out of the room in serious banks.

But of course, Deltec will say it did KYC on tether[footnote]Really solid KYC, clearly, since they’re the last bank on earth taking tether’s business[/footnote], and tether says they do KYC on their customers (the large OTC desks). And I’m sure the OTC desks would be shocked, shocked if the cash money they get in Russia and China turns out to be dirty. So everyone can pass the buck of responsibility down the road and claim “We do KYC on our customers”.

Sure you do, tether. If you did such great KYC, you wouldn’t have such problems finding banking relationships. I mean when even HSBC is not doing business with you you’re apparently more obviously moving criminal money than fucking drug cartels.

And, according to tether’s people, this money is what’s backing tether’s reserves. Money that will get frozen the instant a prosecutor even looks at it.

Reminder: the above is the charitable, positive case for tether.

The less charitable case is that they took crayons and added zeros to their balance sheet, and that there’s a couple billions waiting to burn a hole in the crypto ecosystem.

Anyway, the $25B garbage fire that is tether will make a great book/netflix series at some point [footnote]Seriously, this is both bigger and more fun than theranos[/footnote] and their hilariously stupid CTO going on podcasts while flinching on questions about how BTC ended up on their balance sheet will be a fun part of it.

But I’m not here to write a book, I’m here to make money by shorting all of this. For my purposes, even in the positive case tether is a ticking time bomb waiting to burn a hole in the crypto ecosystem, because…

KYC and AML are coming for cryptocurrencies

If you listen to “crypto news” [footnote]Why would anyone listen to those morons is still a mystery[/footnote], all incoming crypto regulation is just great, because that means crypto is becoming legit. However, companies investing in crypto are very angry about them.

This is because crypto transactions break the FinCEN travel rule, where KYC information should “travel” along transactions, to prevent money laundering obfuscation schemes.

Of course, according to the crypto industry this is “stifling innovation”. A more reasonable take is that by being leaving the crypto industry outside normal financial regulations, we’re enabling a “race to the bottom”. As we saw with shadow banks in the 2000-2007 era this leads to “creative banking”. I don’t want my bankers to be creative, I want them to be solvent.

Tether’s effect on the crypto ecosystem

When tether implodes, it’s taking most of the crypto industry along for a fun ride. Tether can implode in one of a few ways:

-

A BTC price crash triggers it. If it causes a liquidity crisis, the peg on tether could break, exposing the insolvency. This is harder than it seems, because the flight to safety from BTC could be to tether, though.

-

Regulators decide they’ve had enough of AML avoidance and regulate them.

-

The NYAG investigation, which is waiting for an update in a few weeks, finds something and shuts them out.

Let’s assume tether falls to $0 for simplicity. The analysis is the same directionally if tether significantly “breaks the buck” [footnote]drops below the $1 peg[/footnote].

This doesn’t happen instantly, but it happens quickly. The peg breaks, and most people holding tether will try to sell it for other crypto (BTC, ETH, etc.). This puts downward pressure on the price of tether, incentivizing even more people to “pass the buck”. Automated inter-exchange arbitrage bots might try to exploit emerging gaps in bid-ask spreads, only to end up with worthless tether instead, as their operators rush to pull the plug.

Then, we have a small village of cryptocurrency enthusiasts being out some $24B. With the trading bots turned off and the trading lubricant (a dollar pegged asset) gone, the bid-ask spreads blow up. You get a predictable flight to safety – that is, to real money. This puts downward pressure on BTC.

While all of this is happening, there are all sorts of fun second-order effects happen. A lot of DeFi derivative products are priced in cryptocurrencies, so having normally stable prices shuffle around (eg. USDC price moving above $1 in a flight to safety) triggers a tsunami of margin calls. Some exchanges might insolvent (they’re the ones redeeming tether for USD after all).

If BTC price drops below $8000, fun things happen

Currently, the price to mine a BTC is roughly $8000. Most of the mining comes from huge mining farms using subsidized coal in China, and mining costs more the more hardware there is to mine it.

Since the price of BTC hasn’t substantially dropped below cost to mine we’re in for a fun experiment if the price drops below this threshold. Most of these farms should turn off so that the price to mine comes back to breakeven in a case of prisoner’s dilemma.

But if too much hardware turns off, this leaves mining hardware idle and the door becomes wide open to a 51% attack. It’s not clear at what price below breakeven cost to mine a 51% attack becomes a serious threat, but once this threshold is crossed, we’re in the “irreparable harm to BTC” risk zone.

And for a person like me, who just wants to see crypto disappear forever[footnote]and make a few dollars along the way[/footnote] this is very exciting.

Maybe those mining farms could be replaced with nice forests soaking up all the carbon they emitted for posterity. One can hope.

How do I bet against all of this?

Don’t short in general! Even you are correct, market structure makes shorting an inherently unprofitable endeavour. This section explains a gap in MSTR’s pricing. If you wanted to exploit that gap, a better idea is to buy bitcoin and short MSTR to exploit the gap, without trying to short an entire market.

Microstrategy (MSTR) is, at this point, a bitcoin ETF wearing the skinsuit of a dying software company.

Michael Saylor, MSTR’s CEO, is quite the character. I wrote a lot about his lack understanding of what a currency is, but it’s on another level to look at the early stages of a bubble pop and decide this is a good time to buy $10M more of the stuff:

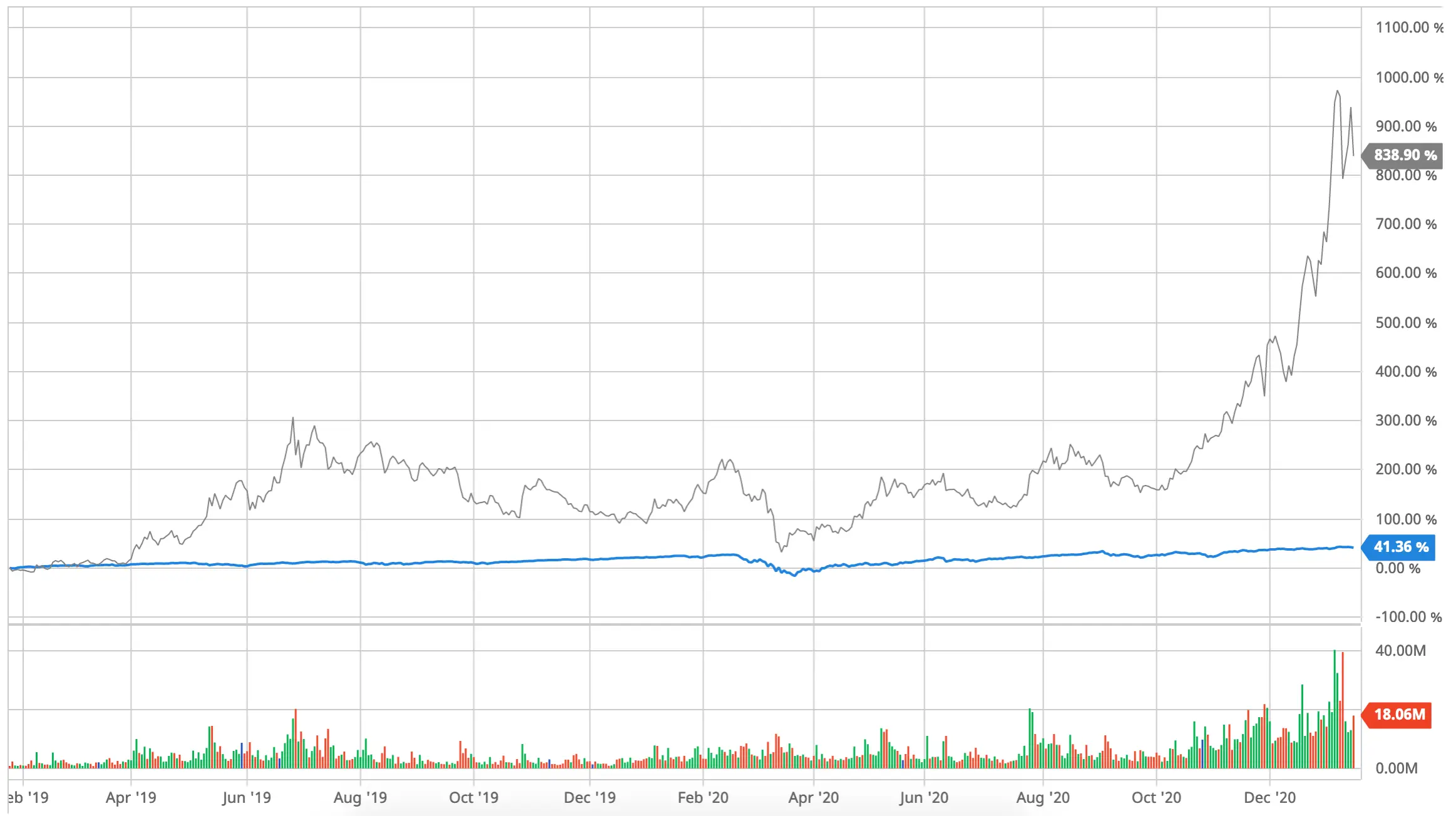

However, this bubble is tame by Michael’s standards. Look at the historical stock of his company:

What’s happening on the left is that Saylor pumped the numbers with accounting fraud then the SEC took issue with the fake numbers. The stock dropped 90% practically overnight. Their accountants, PWC, paid $51M in fines. Saylor and friends paid fines, partly with company stock [footnote]This bodes well for anyone long MSTR when the BTC crash hits[/footnote].

You could also short GBTC, but when Mr. Saylor provides you with an options market instead, why not use it? Shorting on crypto exchanges that might become insolvent in the very event you want to happen with this bet is a bad idea, on the other hand.

Mike can’t cash out

The bitcoin market is illiquid and leveraged when it comes to real money coming in and leaving the ecosystem. Buys in the $10M-$100M seemingly move the price of BTC by upwards of $1000 in the last weeks. This means hundreds of millions of real money means tens of billions in movement in BTC market capitalization.

Now imagine what cashing $1.1B of BTC into real money would mean for the price. And this is purely in market terms, before the PR damage from bitcoin’s demigod abandoning ship would have second-order effects.

Saylor has painted himself into a corner. Even if he wanted to cash out, he can’t.

MSTR fundamentals: Why it should be valued below $10

In early 2020, MSTR was a slowly dying business. The EBITDA has been rapidly evaporating in the last 5 years

At that point, MSTR a stock price of $115 meaning a market cap of $1.1B. This included some $560M of cash they were sitting on. I presume the remaining $550M was an implicit sales premium for the inevitable private equity firm investors expected was going to relieve them of this stock and make the business profitable again.

Of course, they didn’t sell.

Instead, they took the $560m they were sitting on and bought $400m of BTC at prices $11k and $13k in late summer 2020. Then, in early December, they took on $600m of debt to buy BTC with at $23k. They also bought $10m more in January at a price of $30.5k.

At this point, we can mostly value MSTR like a trust.

-

Price the underlying software business as being worth $600M, as the market did before the bitcoin nonsense. If BTC went to $0, this is what we’d value it at, and the MSTR stock should be around $65.

-

But wait! MSTR took on $650M in debt in December. Their actual value with a BTC priced at $0 should be much, much lower than $65 depending on how you value the debt. You could make an argument it should be in the single digits.

-

They hold 70,784 BTC. At current prices ($32,000) this is worth roughly $2.2B. With the current market cap of MSTR ($577 stock price), this means MSTR is currently priced at an eye watering $3B premium over fundamental value.

GBTC’s 20% premium-to-NAV is a joke compared to the MSTR premium.