Is USDC another Tether?

TLDR: No, but it has different risks

Disclaimer: I have short positions on COIN, which partly owns Circle.

Following my piece on tether (USDT), some people have advanced that a similar stablecoin, USD Coin (USDC) is similarly shady. Let’s review it!

USDT and USDC are linked

In my tether post I noted that crypto liquidity firms [footnote]Basically, bots that arbitrage price spreads between exchanges. They sometimes call themselves “market makers”[/footnote] all stopped at once on May 19th 2021. Within minutes, the price spreads between exchanges caused a flash crash. The implied USDT peg also wobbled, though this may have happened before (causing liquidity firms to abruptly stop) or after (as a result of price spreads across exchanges).

In any case, the flash crash was either caused by, or has caused, a switch of FTX [footnote]and its market making firm, Alameda trading[/footnote] from USDT to USDC. See this data I compiled from blockchain transactions:

Here, the first two rows are where newly issued USDT and USDC go. The bottom two rows are where redeemed USDT and USDC come from.

Note FTX visibly switched from issuing USDT to issuing USDC around May 19th. They plugged into the USDC infrastructure right before, on May 14th. So either they saw something coming for tether, or they clicked the wrong button when making the switch and cause a flash crash (oopsie!)

Chinese Capital Control Evasion?

One interesting pattern in stablecoin data is that FTX issued USDT and redeemed USDC prior to May 19th. FTX is largely used in China, and not so much in places that touch the USD:

The Chinese government limits capital outflows to $50,000 per year. This is a problem to businessmen who want to ensure their fortune is safe from Xi Jinping’s wrath, so laundering money through USDT and Hong Kong has been popular

This pattern fits with a competing theory to the “Tether Ponzi Scheme” idea: USDT used in Chinese capital control evasion. Since redeeming USDT for USD is difficult (tether doesn’t have much accessclean USD banking), trading USDT to USDC and redeeming USDC may be simpler. USDC has access to USD banking, as does sister company Coinbase.

If this theory is the case, USDC is an accesory to money laundering, which is, uh, an issue.

USDC Actually sees redemptions

We know tether serves redemptions through sister company bitfinex.

First, we see it in the redemption data above – Bitfinex did most redemptions before May 19th.

Second, here’s Alameda trading claiming transactions to bitfinex were redemptions. Tether also admit it in interviews.

We also know tether commingled funds with bitfinex in the past [footnote]See NYAG settlement in my last post[/footnote]. It’s entirely possible tether pays redemptions with bitfinex customer funds. Or with a bitfinex account credit. Tether executives likely use tether and bitfinex’s money as a single slush fund, using liquidity for redemptions and withdrawals as needed [footnote]They certainly have in the past, “loaning” money between the companies to paper over financial holes[/footnote].

On the other hand, USDC seems to have a more consistent redemption pattern. They actually service these redemptions from a segregated customer fund as far as we know.

This speaks well of USDC, but it also makes it more likely for USDC to see a bank run. Tether only allows redemptions from its “customers” - a dozen or so exchanges and large trading firms. By making it easy to redeem, USDC make it easier in bad times for its customer funds to see a panic selloff.

USDC actually had the money at some point

USDC planned to go public in mid-2021 through a SPAC. In preparation for this, they prepared audited financials with a real, serious accounting firm Grant Thornton [footnote]Unlike tether, who prepare attestations with the 5-person firm Moore Cayman – not a serious accounting firm in my opinion[/footnote] which we can find here:

As you can see in the third line, in December 2020, all of the USDC out there on the blockchains were Fully Backed By Reserves™ with actual money in an actual bank account.

…but it was still insolvent

A complex business model like “someone gives you a dollar and you put it in a bank account” is expensive to run[footnote]Apparently $20m in salaries per year![/footnote]. So of course Circle was insolvent in December 2020. In fact they stated that they would need to find money soon, or else they’d risk bankruptcy, according to their accountants:

The Company’s ability to continue operations after its current cash resources are exhausted depends on its successfully securing additional financing or achieving profitable operations in the medium term.

Some of that was because of ill-advised acquisitions, like the Poloniex exchange, but also the fact that no one really cared much about stablecoins before spring 2020:

How did Stablecoins become popular?

DeFi and stablecoin demand were effectively bootstraped by tether suddenly sending billions to DeFi entities in March/April 2020 (the “other” categories in last section’s issuance plot). This dropped DeFi interest rates and made DeFi borrowing a realistic idea. DeFi then exploded in popularity:

Which generated some additional demand for new stablecoins to lock up in DeFi lending protocols.

Another driver of tether is margin trading collateral. Back in 2017-2018, derivatives trading platforms like Bitmex exploded in popularity. The point of platforms like this is to separate d̶e̶g̶e̶n̶e̶r̶a̶t̶e̶ g̶a̶m̶b̶l̶e̶r̶s̶ traders from their money, by offering ridiculous leverage (up to 100x, meaning a 1% reduction in price liquidates the position) and actively trading against their own customers to ensure they get liquidated [footnote]Sidenote: if you think FTX, which has a proprietary trading arm called Alameda, doesn’t trade against its own clients, I have a bridge to sell you[/footnote].

Binance had two key advantages in 2020. First, Bitmex directors got indicted for money laundering. This (unsurprisingly) dropped Bitmex trading volumes. Second, instead of asking for margin in Bitcoin (a volatile asset), it asked for (stable) USDT margin.

The Binance high leverage USDT-denominated futures contracts are very popular, and, as found in this study, their leverage-driven volatility drive much of volatility of all prices everywhere else:

Binance holds anywhere between 15B and 20B USDT, presumably this is mostly Binance customers posting USDT collateral for margin trading.

We don’t see this as much for USDC, however! It’s possible FTX, who also offer ridiculously leveraged futures contracts, take up the “leveraged garbage” torch from Binance, who took it from Bitmex – but it’s not seen in the data at the moment.

Another important question is why tethers remained in the market when core demand drivers (margin collateral, DeFi lending) all dropped 30-50% between May and June 2021:

The cynic’s answer is simply that tether can’t handle any significant volume of redemption without collapsing and closely tied players like Binance’s existence is tied to tether, so they do whatever they can not to redeem.

The Reserve Swap

In December 2020, there were $4B USDC and they were all backed by dollars in a bank account. On May 28th, 2021, USDC reserves looked like this:

Note that this reserve breakdown is an attestation, not audited like the December 2020 $4B cash number. The accountants just report what Circle (the company that owns USDC) told them.

This is somehow even more opaque reserve disclosure than tether!

Since we never had an audit for what these reserves consist of, they could be really anything. In particular, the “cash & cash equivalents” section can include short term commercial paper, so USDC could be backed by up to 70%[footnote]61% + 9%[/footnote] unnamed commercial paper!

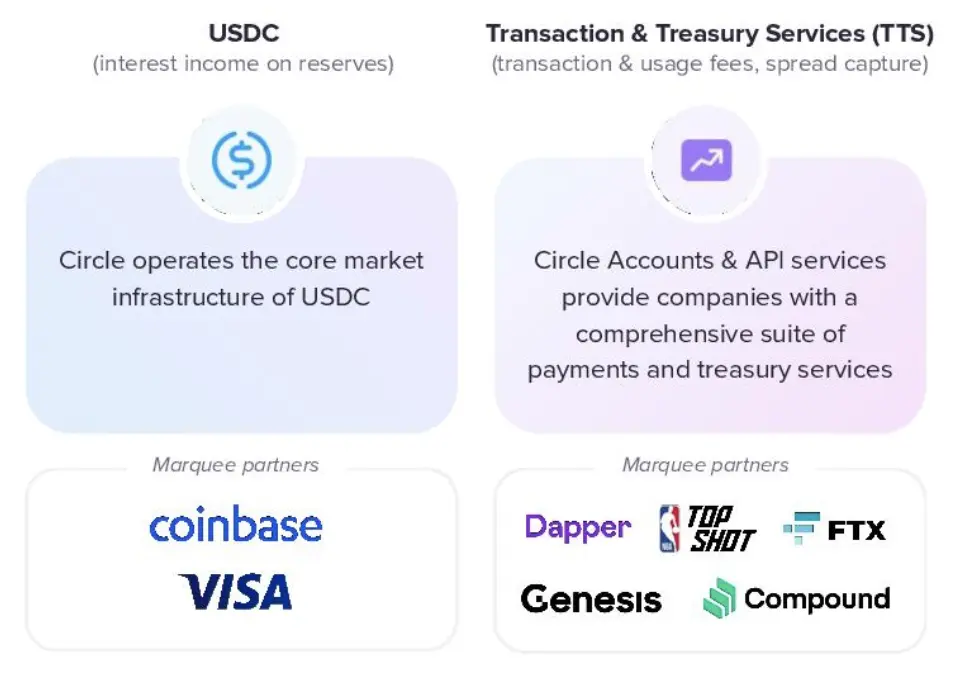

We know that the money coming from Coinbase is probably real, because Coinbase has legitimate USD banking. This is even hinted to in their own public offering pitch deck, where they separate “Core USDC infrastructure” (Coinbase) from “Transactions” (FTX, DeFi protocols):

Who knows what comes from FTX! As put in USDC’s pitch deck risk section: “Our products may be used to facilitate fraud, money laundering, tax evasion and scams”. I wonder what kind of KYC and AML procedures they’ve done for FTX, which, again, largely operates in Hong Kong/China, not with US Dollars.

The world’s worst Money Market Fund

Stablecoins exist in grownup finance, they’re called “Money Market Funds” (MMFs). All MMFs disclose everything they have, down to the specific securities identifier of what they bought. As noted by Matt Levine:

“We don’t disclose our commercial partners, so that is quite important,” says Tether CTO Paolo Ardoino at around the 5-minute mark. “Given our portfolio composition in commercial paper, we believe that it is quite important to respect the privacy of the banking partners that we work with.” That’s not a thing! That’s not a thing at all! Every money-market fund just lists all of its holdings, by size and issuer and CUSIP! Tether has broken new ground in the concept of commercial-paper privacy rights! But, why?

What’s concerning is that USDC is on the same sort of “private MMF” model. Why would they do that if they just have normal, good assets? And why did they silently switch the asset makeup while insolvent in early 2021?

Conclusion: Not as bad as tether

USDC clears the lowest possible bar: it’s not as shady as tether. It had all the money at some point, something tether can’t claim. But USDC has been making quizzical choices and questionable alliances, all while under the pressure of insolvency. Moreover, USDC actually services redemptions unlike tether. This ease of use is good, but brings more serious bank run risks. Buyer beware.